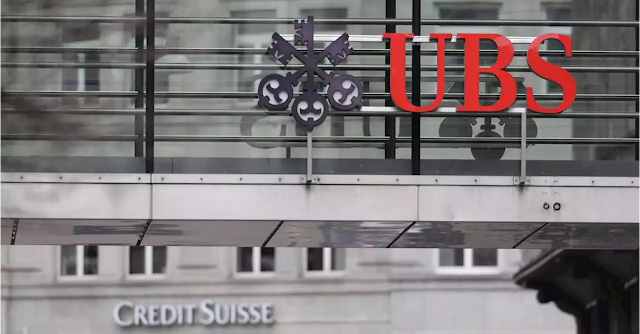

Swiss banking predominant UBS Chairman Colm Kelleher on Wednesday stated that the sudden takeover of rival Credit Suisse a sizeable milestone for Switzerland and for the worldwide monetary industry, which includes a “large quantity of risk”.

Addressing the yearly shareholder assembly on Wednesday, Kelleher stated that the takeover will take as a minimum 3 to 4 years to take shape, except Credit Suisse`s non-center funding financial institution portfolio, with a view to have extra than $five trillion in general invested assets.

Describing the transaction as "the primary merger of globally systematically critical banks," Kelleher stated the takeover "way a brand new starting and large possibilities in advance for the blended financial institution and for the Swiss monetary middle as a whole."

“Having a clean imaginative and prescient and a valid method is critical….This transaction is the primary merger of worldwide systemically critical banks. This isn't in any manner an smooth deal to do and brings with it execution risk,” Kelleher stated.

Last month, Swiss government introduced that UBS could purchase Credit Suisse in a shotgun merger to incorporate in addition banking turmoil after the worldwide lender had come to the edge of collapse. Kelleher`s deal with on Wednesday changed into the primary assembly after the announcement, in which 1,128 shareholders gathered.

He delivered that UBS will cognizance on its wealth control and Swiss enterprise and showed that the financial institution could lessen the capital allotted to its funding arm to under 25 in step with cent of risk-weighted assets.

Outlining UBS`s method, Kelleher stated the Credit Suisse takeover could assist the financial institution to supply fee to the Swiss financial system and boost up its strategic plans to make bigger its role because the main wealth supervisor worldwide, especially thru boom in outstanding markets just like the US and Asia.

“Whilst we did now no longer provoke those discussions, we agree with that this transaction is financially appealing to UBS shareholders,” Kelleher stated.

He delivered that there's a “large quantity of risk” related to the integration, with a view to have extra than $five trillion in general invested assets.

Kelleher stated UBS expects to stay properly capitalised and “considerably above” its capital goals by the point the deal closes.

In 2022, UBS pronounced a full-12 months income of $7.6 billion, even as its stocks won extra than 10 in step with cent for the reason that flip of the 12 months.

Last week, UBS stated it had rehired Sergio Ermotti as the brand new leader government to persuade the huge takeover, which got here as a marvel move.

Experts sense Ermotti`s go back to the financial institution changed into deliberate to repair calm, because the country`s long-mounted recognition for monetary balance changed into shaken after the Credit Suisse crisis.

On Tuesday, Credit Suisse Chairman Axel Lehmann, even as addressing the ultimate AGM of the flagship financial institution, apologised to the shareholders for failing to incorporate the crisis, which brought about its closure. In an emotional speech at Credit Suisse's ultimate annual preferred assembly, chairman Axel Lehmann talked about being stuck off guard, pain, bitterness, collected scandals, and the grief that remains.

In his starting deal with on the ultimate AGM, Lehmann stated that he had run out of time to show the financial institution around, regardless of his belief "till the start of the fateful week" that it can survive. He stated: "It is a unhappy day. For all of you, and us. The bitterness, anger, and surprise of all people who are disappointed, overwhelmed, and tormented by the trends of the beyond few weeks are palpable."

Earlier it changed into pronounced that the merger ought to see as much as 36,000 jobs being reduce throughout the world. On Sunday, Swiss newspaper SonntagsZeitung Weekly stated control changed into mulling slicing among 20 in step with cent and 30 in step with cent of the workforce, which means among 25,000 and 36,000 jobs throughout countries.

About 11,000 jobs can be reduce in Switzerland alone, in step with the weekly, which did now no longer offer info of which posts can be targeted. Before the merger, UBS and Credit Suisse hired barely extra than 72,000 and 50,000 people, respectively.